What Is A Reverse Stock Split Example

The process involves a company.

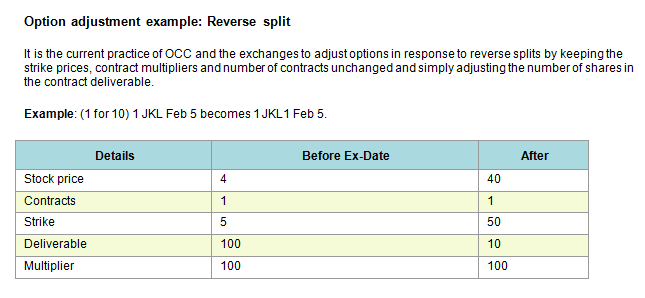

What is a reverse stock split example. For example in a 1 for 10 reverse stock split shareholders receive 1 share of the company s new stock for every 10 shares they were holding. Example of a reverse forward stock split for example if a company declares a reverse forward stock split it may start by exchanging one share for every 100 shares that the investor holds. For example a 2 1 reverse stock split would mean that an investor would receive 1 share for every 2 shares that they currently own. A reverse stock split as opposed to a stock split is a reduction in the number of a company s outstanding shares in the market.

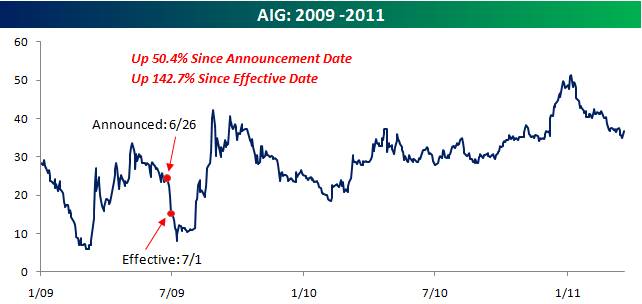

A reverse stock split is when a company decreases the number of shares outstanding in the market by canceling the current shares and issuing fewer new shares based on a predetermined ratio. On the date of occurrence all the common shareholders stock will be called in and exchanged for a lesser amount. It is typically based on a predetermined ratio. Exploring an example one of the many reasons a reverse stock split might occur is to boost the attractiveness of a company s stock prior to significant changes such as the splitting of a company.

For example in a one for ten 1 10 reverse split shareholders would receive one share of the company s new stock for every 10 shares that they owned. Example 1 samantha an investor is currently holding 500 shares of xyz limited at a value of 20 per share. A reverse stock split reduces the number of shares and increases the share price proportionately. A reverse stock split is a type of corporate action which consolidates the number of existing shares of stock into fewer proportionally more valuable shares.

When a reverse stock split is declared the corporation sets a date that all outstanding common shares will be called in. For example a 1 for 2 reverse split will exchange one new share for 2 existing shares. If a shareholder owned 1 000 shares before. If an investor previously owned 100 shares he would now own 10 shares after the.

For example if you own 10 000 shares of a company and it declares a one for ten reverse split you will own a total of 1 000 shares after the split.

/GettyImages-1051266664-b8064d1c16f74ff9b139fe2ee7affa18.jpg)