What Is A Beneficial Owner Aml

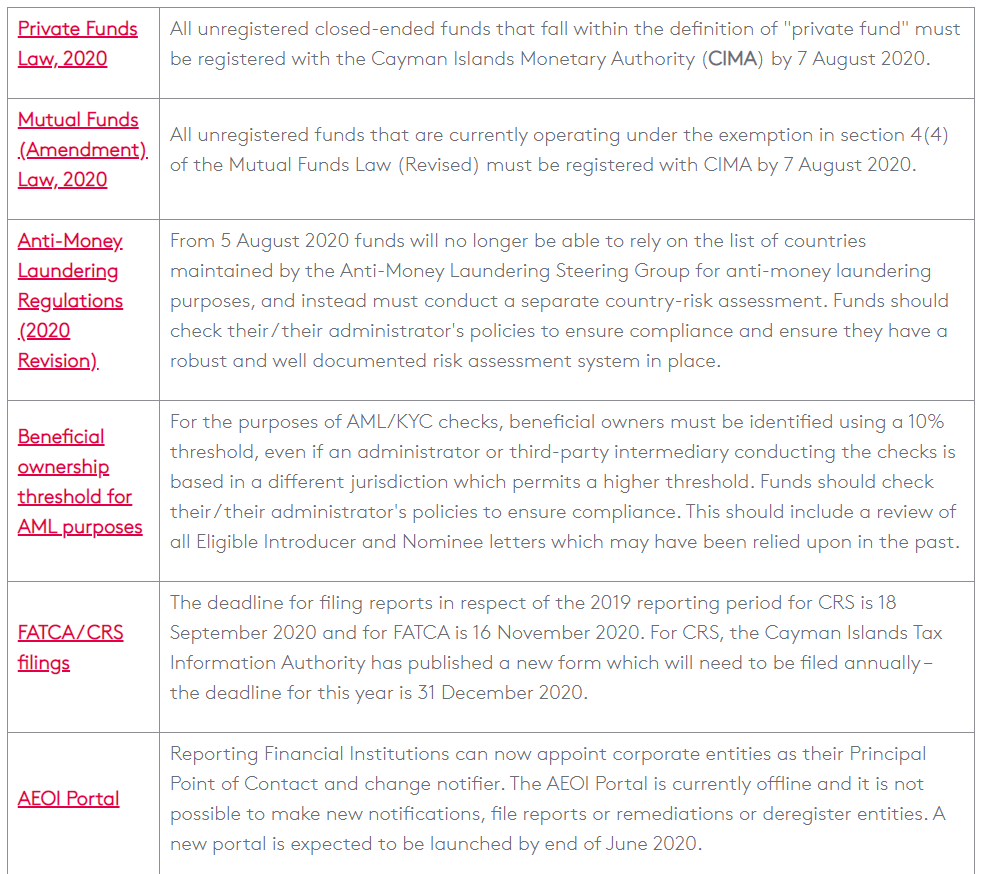

Owns in this case means owning 25 or more of the entity.

What is a beneficial owner aml. According to the fatf beneficial owner refers to the natural person s who ultimately owns or controls a customer and or the natural person on whose behalf a transaction is being conducted. It also means any individual or group of individuals who. The aml cft beneficial ownership guideline and associated fact sheets are to assist reporting entities in meeting the requirement to perform customer due diligence on the customer and beneficial owners of the customer under. Holds directly or indirectly more than 25 of the capital or profits or voting rights.

This can be directly such as through shareholdings or indirectly such as through another company s ownership or through a bank or broker. The company itself must disclose all of their beneficiaries upon a business verification check. A beneficial owner is anybody who holds shares in a company. Beneficial owner this should include.

A beneficial owner is an individual who ultimately owns or controls an entity such as a company trust or partnership. It also includes those persons who exercise ultimate effective control over a legal person or arrangement. It is a person within the parent company that. Well worth reading for all australian reporting entities especially the vast majority of reporting entities who struggle with the whole concept of beneficial ownership.

It also includes those persons who exercise ultimate effective control over a legal person or arrangement. An ultimate beneficial owner ubo is an individual that benefits from or is impacted positively from a company even though they are not formally named as the owner of a business. A beneficial owner is a person who enjoys the benefits of ownership even though the title to some form of property is in another name. How to learn about a company s ubo.

Or exercises ultimate control. Austrac recently produced a factsheet entitled meeting your beneficial ownership obligations. Beneficial ownership outlines the identity of persons with a controlling interest in a privately held business enabling an fi to understand the ultimate recipient of a financial transaction.