What Does Eps Mean In The Stock Market

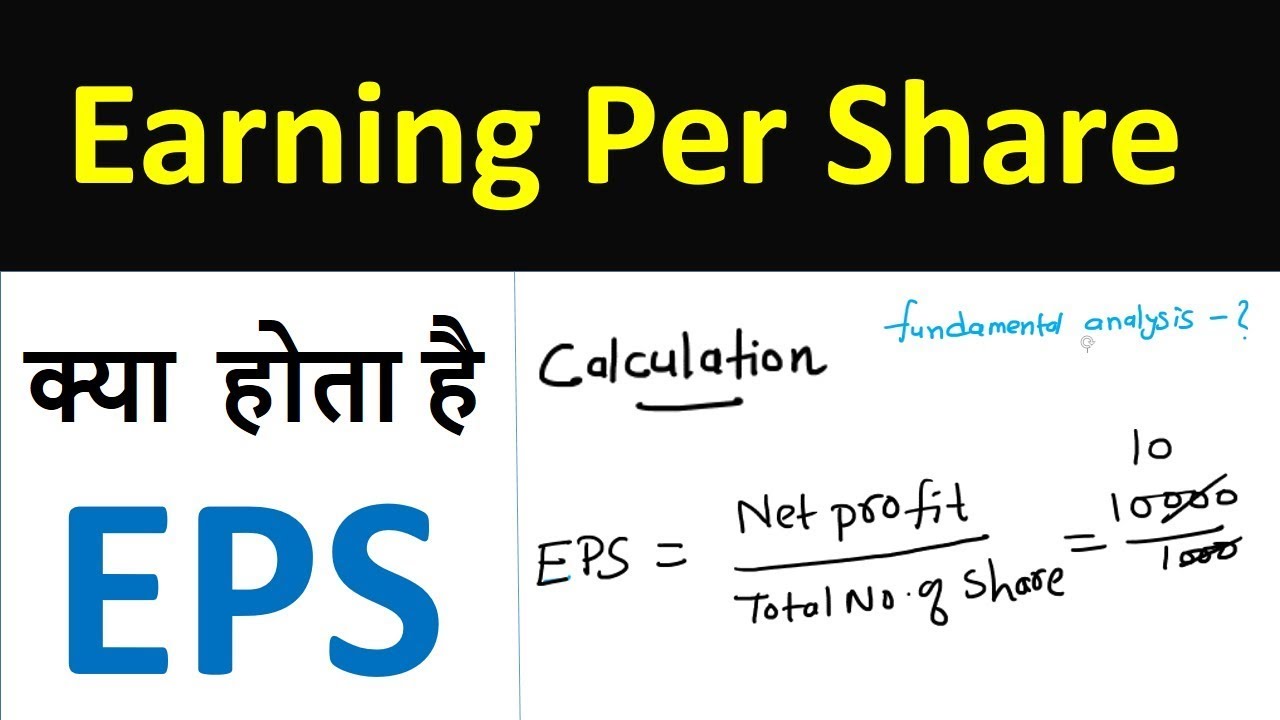

For example a company with 800 million shares outstanding makes 1 billion in annual profit that s 1 25 per share.

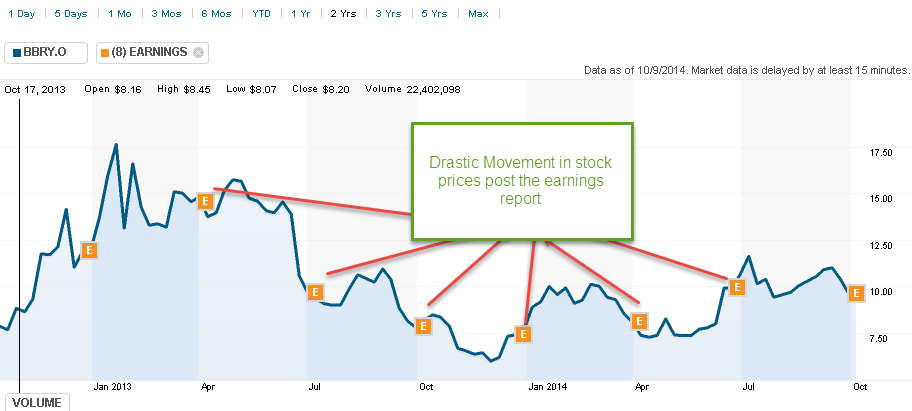

What does eps mean in the stock market. Earnings per share serve as an indicator of a company s profitability. The higher the earnings per. If the market price of our xyz corporation stock is 15 when the company s eps is 1 then the p e ratio is 15. A 99 score means a company has stronger profit growth than 99 of the entire market.

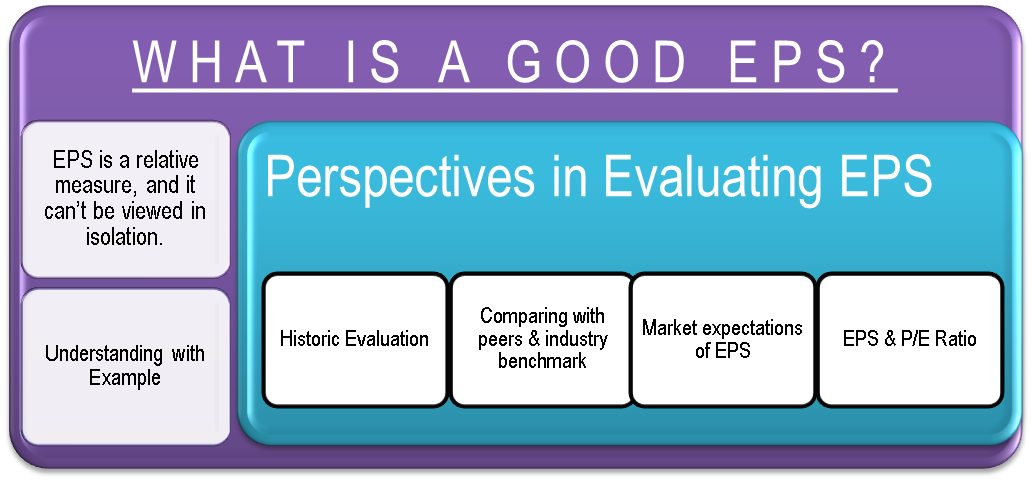

P e 40 2 20 a high p e ratio indicates that investors expect a company to report higher earnings in the future. In stock market terms earnings per share is abbreviated as eps. The stock is selling for 15x more than its earnings per share. Good earnings per share or eps in the stock market depends largely on expectations.

If a stock has an annual eps of 2 and a stock price of 40 a share then the p e ratio will be. An investor might use this to help judge whether a stock. Both wall street analysts and corporate executives generally identify a number or range expected for profits. Use the eps rating.

Earnings per share eps is the portion of a company s profit allocated to each outstanding share of common stock. Earnings per share is the company s net earnings divided by the number of shares outstanding. Earnings per share eps a company s profit divided by its number of common outstanding shares if a company earning 2 million in one year had 2 million common shares of stock outstanding its eps. Eps is the portion of a company s profit that is allocated to every individual share of the stock.

It s a measure of how much profit or loss a company saw in a particular period divided by the number of outstanding shares in its. If a stock is trading at 30 and its basic eps for the year is 3 20 then it can be said that the firm s p e ratio is about 9 4. The price to earnings ratio or p e ratio.

/ForcesThatMoveStockPrices2-d78bc38c16c743ffa0a8cf63184934a7.png)