Weighted Average Number Of Common Shares Outstanding

Obtain the total value of all shares within a company s stock.

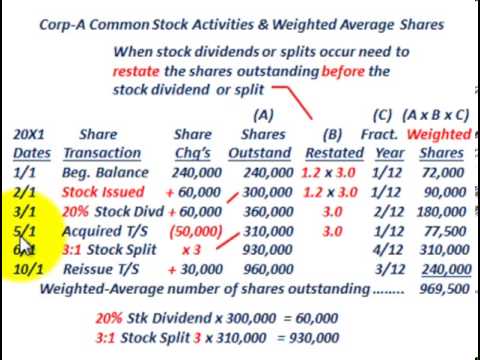

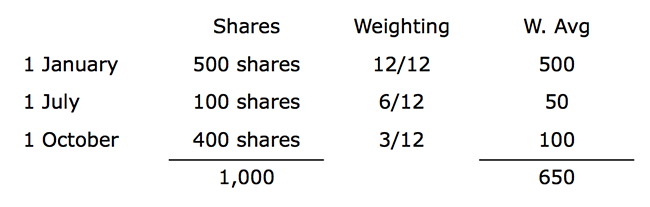

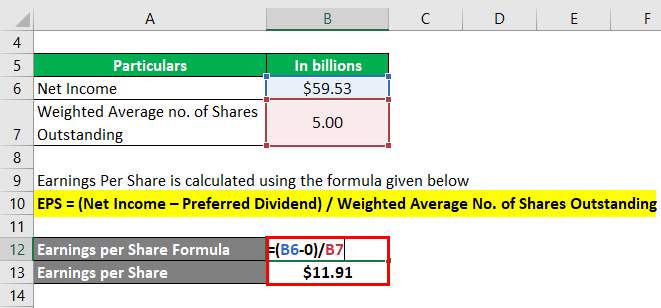

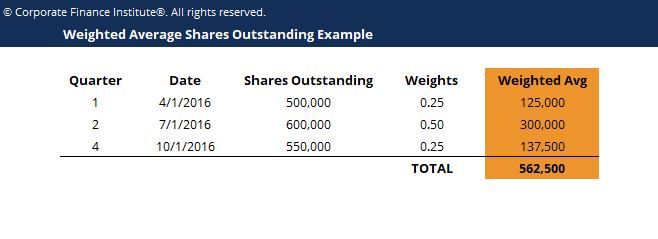

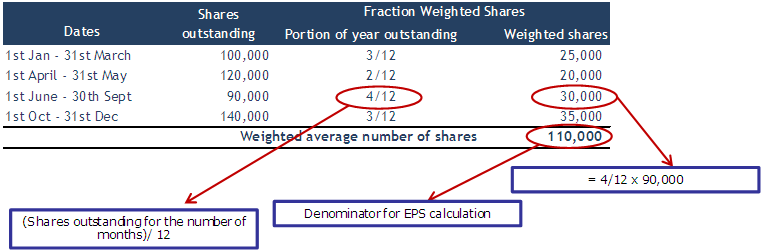

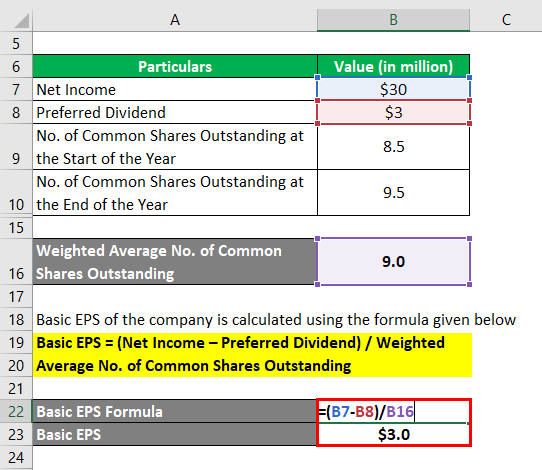

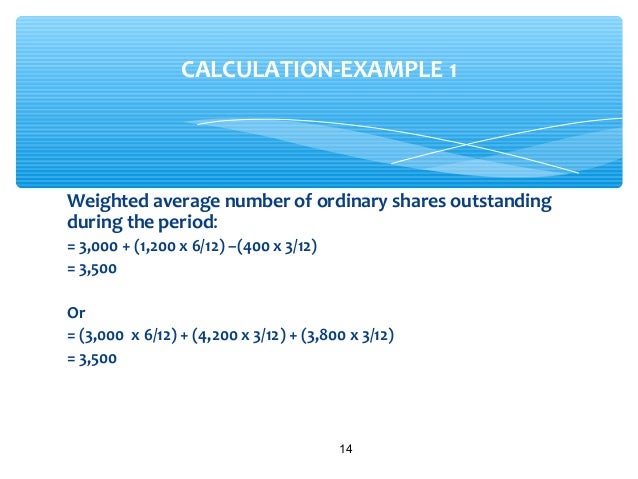

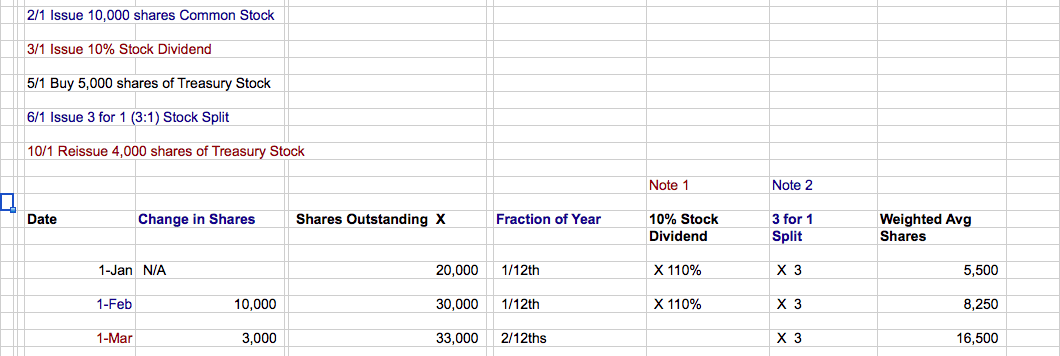

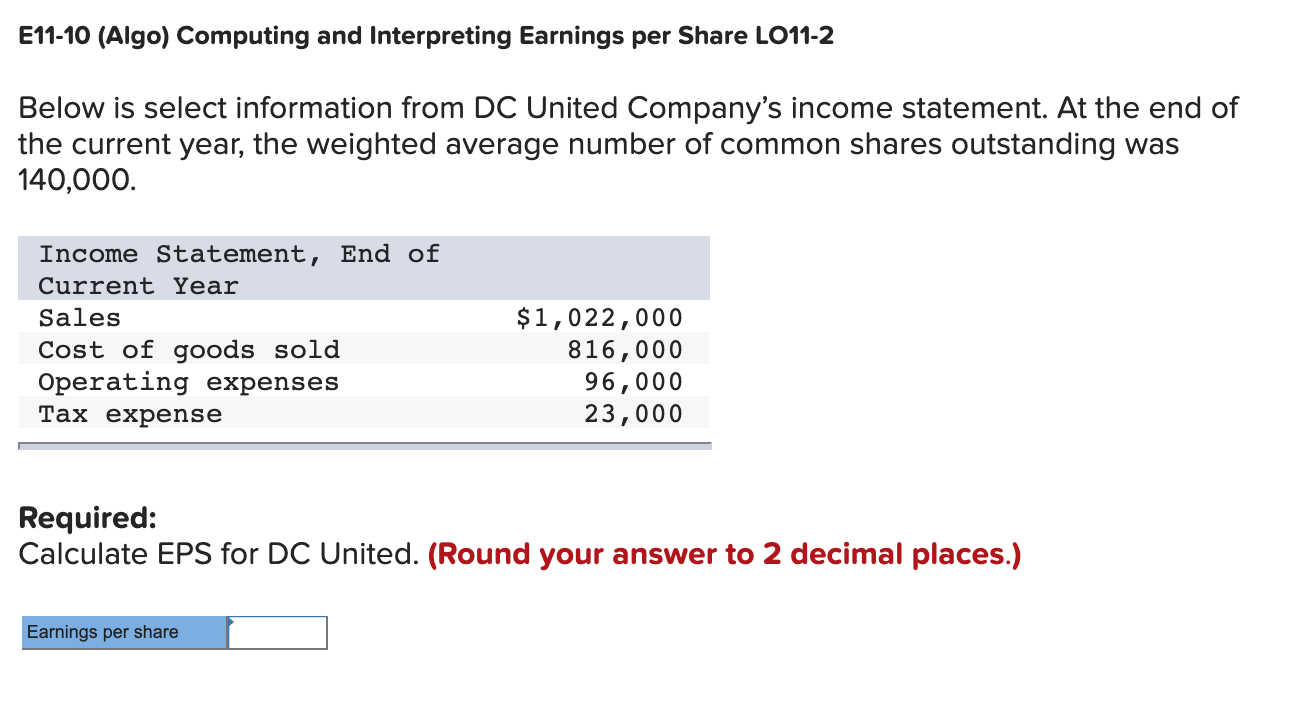

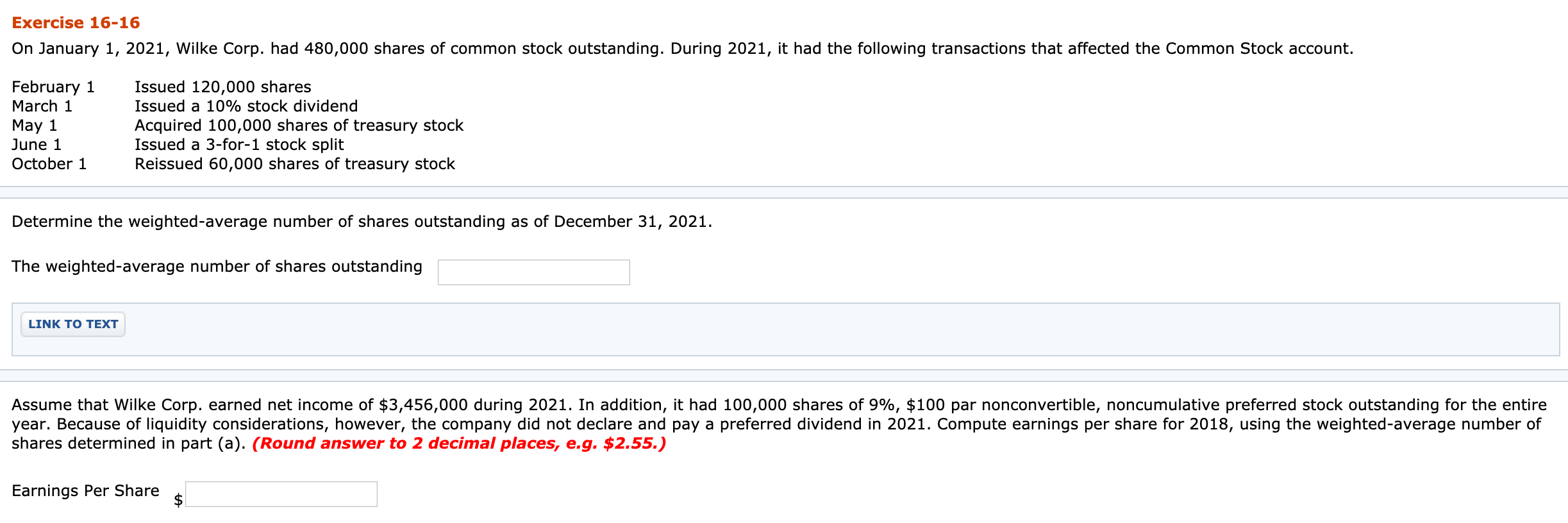

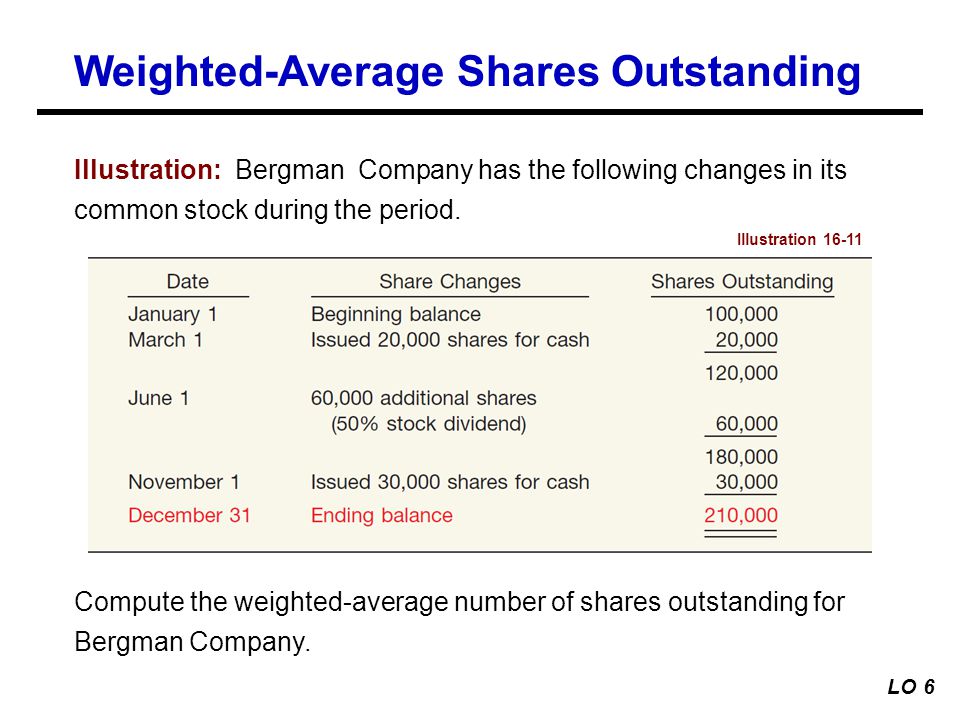

Weighted average number of common shares outstanding. The weighted average shares outstanding or the weighted average of outstanding shares is a calculation that takes into consideration any changes in the number of outstanding shares over a. To illustrate the difference between simple average and weighted average suppose a company has 10 000 shares outstanding at the beginning of the year and 20 000 shares outstanding at the end of the year. The weighted average number of shares is calculated by taking the number of outstanding shares and multiplying the portion of the reporting period those shares covered doing this for each portion. Further the number of shares used in computing the average are to be weighted by that fraction of the year that they were actually outstanding.

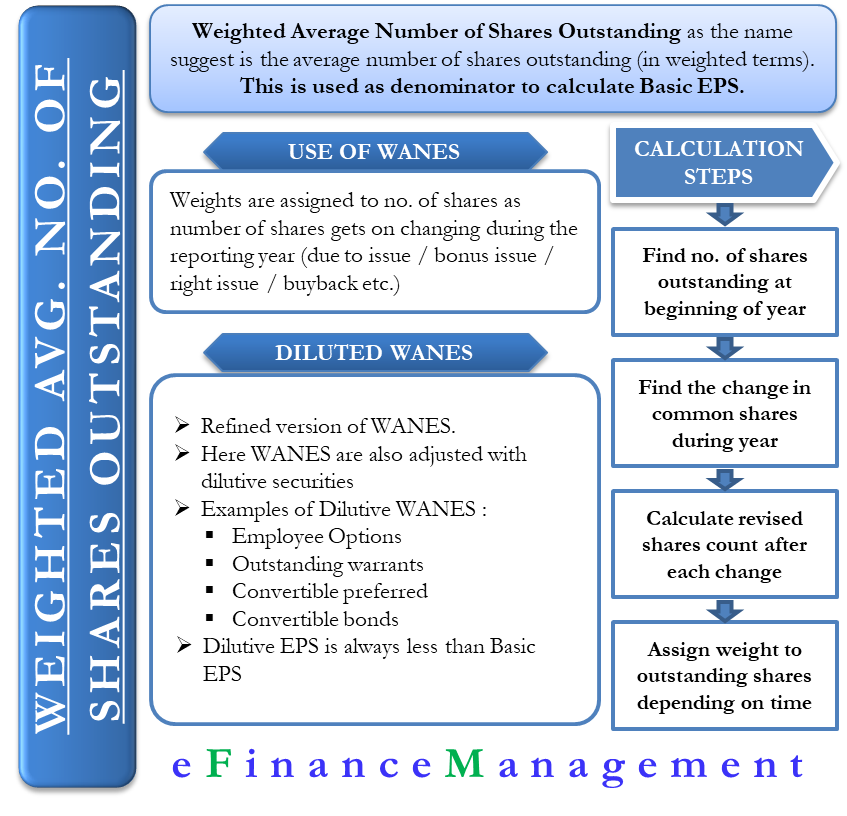

Weighted average shares outstanding is a number of shares of the company after incorporating changes in the shares during the year. Second find the change in the common shares during a reporting year. The number of shares of a company can vary during the year due to various reasons. Steps to calculate weighted average shares outstanding first find the number of common shares outstanding at the start of the year.

Third calculate the updated common share count after each change. Weighted average shares outstanding refers to the number of shares of a company calculated after adjusting for changes in the share capital over a reporting period. When the number of outstanding shares is changed by a stock dividend or split the firm s earning power is not affected. E g like buyback of shares the new issue of shares share dividend stock split conversion of warrants etc.

Divide the total by 12 the number of months in a year to find the weighted average common shares outstanding. Weighted average number of common share outstandingの意味や使い方 加重平均普通株数 約1161万語ある英和辞典 和英辞典 発音 イディオムも分かる英語辞書 ピン留めアイコンをクリックすると単語とその意味を画面の右側に残して. The number of shares of a company outstanding is not constant and may change at various times throughout the year due to a share buyback new issues conversion etc.