Time Weighted Rate Of Return Calculation Example

After the cash flow occurred the portfolio returned 3 42 for the remainder of the month a relatively worse return than the first half of september.

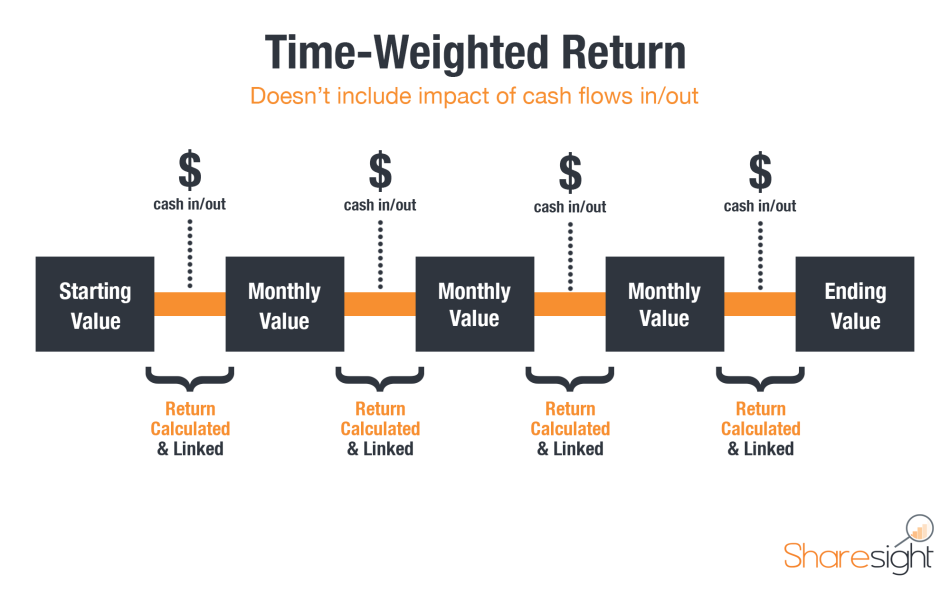

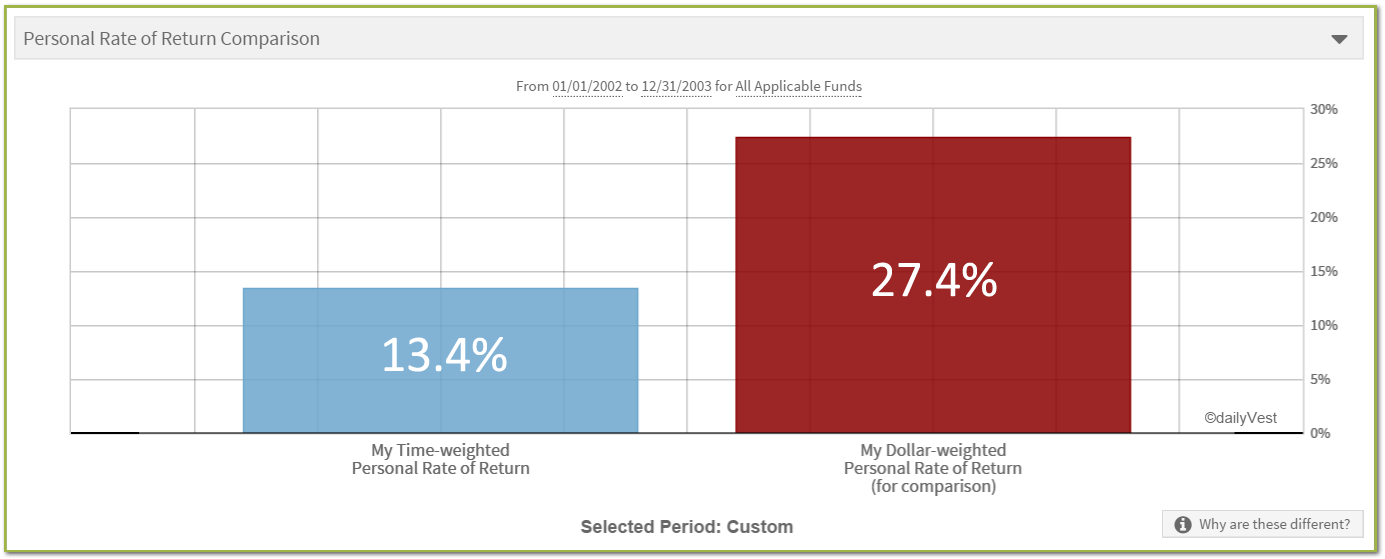

Time weighted rate of return calculation example. The continuous time weighted rate of return over the ten year period is the time weighted average. Time weighted rate of return for investor 1 investor 2 initially invested 250 000 on december 31 2013 in the exact same portfolio as investor 1. Ordinary time weighted rate of return example 3. Today the time weighted rate of return is the industry standard since it provides a fairer assessment of an investment manager s performance.

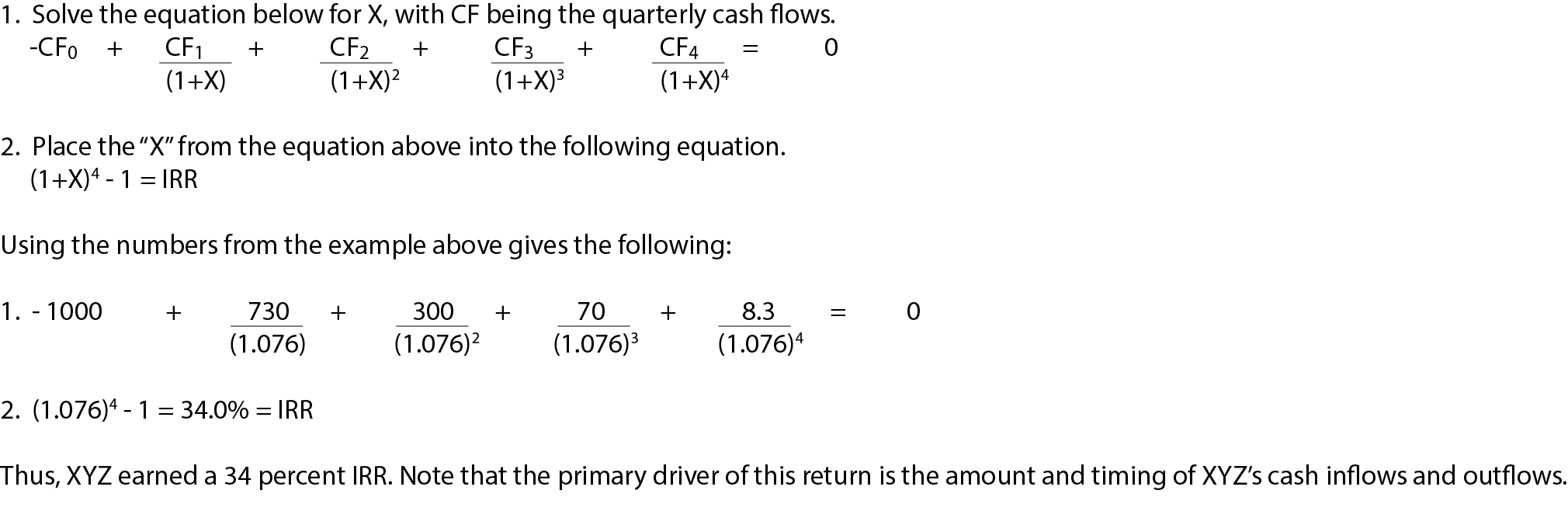

Time weighted return sally can now calculate the time weighted return. R tw 1 0 2 xx 1 0 1 xx 1 0 15 xx 1 0 1 1 r tw 1 2 xx 0 9 xx 1 15 xx 1 1 1 r tw 0 3662 or as a percentage. Twr 1 rn 1 rn 1 100. The time weighted return over the two time periods is calculated by multiplying or geometrically linking these two returns.

Twr time weighted return n number of periods hp end value initial value cashflow initial value cashflow hp n return for period n an example of the time weighted return let s say you invest 500 000 in. Time weighted rate of return for the month of september investor 2 for both investors their sub period rate of return before the cash flow occurred was 0 85. On september 15 2014 their portfolio was worth 290 621. How to calculate time weighted return example of subperiod returns throughout january.

Time weighted return 1 16 25 x 1 5 56 1 9 79 as. The subperiod returns are then linked to calculate the total weighted return. Time weighted return calculator this page calculates the time weighted return for an investment given the investment valuation and any deposits and withdrawals on a series of dates.